MOSS

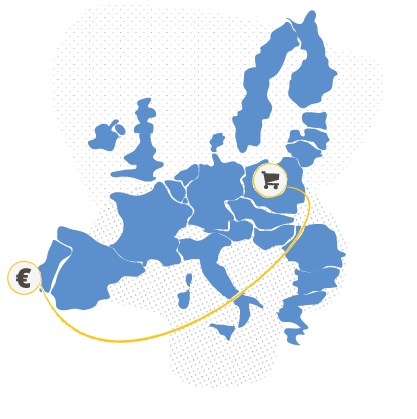

O Regime da União aplica-se aos sujeitos passivos estabelecidos em território nacional, ou seja, que têm a sede da sua atividade ou um estabelecimento estável neste território, desde que prestem serviços de telecomunicações, de radiodifusão ou televisão e serviços por via eletrónica, a pessoas que não sejam sujeitos passivos, estabelecidas ou domiciliadas na União.

O Regime Extra-União aplica-se aos sujeitos passivos não estabelecidos na União, ou seja, que não têm a sede da sua atividade, não dispõem de um estabelecimento estável e que não estão nem devam estar registados para efeitos de IVA em qualquer Estado membro, desde que prestem serviços de telecomunicações, de radiodifusão ou televisão e serviços por via eletrónica, a pessoas que não sejam sujeitos passivos, estabelecidas ou domiciliadas na União.